CUSTOM JAVASCRIPT / HTML

Life is Short, Retire Early

How To Retire Early From Anywhere Using Bitcoin

Learn The Simplest, Fastest & Cheapest investing strategy to retire early.

.

Learn The Simplest, Fastest & Cheapest investing strategy to retire early.

Retire early from anywhere!

Why Retire Early?

Top 10 Reasons to Retire Early:

1. You can afford to live without a job.

2. You are not able to work anymore.

3. Your parents retirement was too short.

4. Health issues may limit your mobility.

5. You want to live a more simple life.

6. You want more free time to enjoy your life.

7. You desire to travel the world.

8. You want to live a more affordable life.

9. You want to relocate for love.

10. You need to take care of family living abroad.

What will your retirement look like?

Retirement is not a specific age, it is a number in your bank account.

Once you hit that magic number, you can stop working daily and spend your time however you desire. You can buy back your time.

Don't wait until your 65 years old to start enjoying life... Plan your future today!

How It Works?

Retirement.net offers a simple early retirement online course focused on Bitcoin investing. We show investors step-by-step, how to safely invest in Bitcoin. The Perfect Bitcoin Retirement Plan is ideal if you are a busy professional, parent, investor or even unemployed.

Learn how to retire early from anywhere using Bitcoin on your smartphone. You don't need to wait until your 65 to start enjoying life and you certainly don't need to be a millionaire to retire early. Just copy our proven bulletproof Bitcoin portfolio from anywhere. You can retire early in 3 simple steps...

1. Plan Expenses

Calculate your estimated monthly expenses

2. Apply Strategy

3. Financial Freedom

Automate paying all your monthly expenses

Who is Retirement.net?

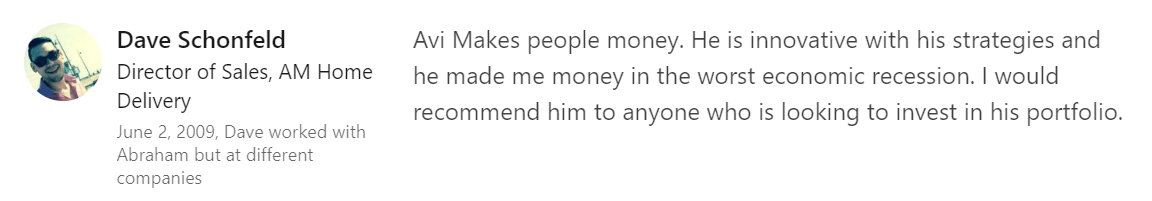

Hey, my name is Avi Rosner and I retired early at the ripe old age of 31. I was financially ready to start my real life with my wife and put a pause on my work life. In the process, I learned how to supplement my income by investing in bitcoin. Now, I no longer worry about running out of money during retirement. I simply applied a proven investing strategy called The Perfect Bitcoin Retirement Plan. This website reveals my crypto investing success and my expensive mistakes. Investors seeking income or anyone looking to retire early, can follow my simple step-by-step instructions. The exact same proven methods I used is shared with all clients who sign up to The Perfect Bitcoin Retirement Plan. You don't need to wait until your 65 to start enjoying life and you certainly don't need to be a millionaire to retire early.

Building a bulletproof portfolio using bitcoin has become the focus of my investing and allowed me to retire 35 years before most people can afford to. Crypto investing and financial independence is my passion. If you want to be the average person, then wait until age 65 to retire. If you want to retire early, then you are going to have to invest wisely now. Retirement is not an age, it is a number in your bank account. When you reach that number you do not need to work anymore. You too can retire early from anywhere. The Perfect Bitcoin Retirement Plan can simply help you get there faster.

Why invest in Bitcoin?

Simply put Bitcoin is better money but it is not accepted by all merchants yet. It is scarce, durable, portable, divisible, uniform, fungible and acceptable. Bitcoin was designed to beat inflation. Every 4 years it will become twice as difficult for miners to earn bitcoin, until all 21 million coins are mined. Compare that to the unpredictable S&P 500 performance. You don't need to be a millionaire to retire early. When you retire early, you need a bulletproof portfolio that can beat inflation, taxes and healthcare costs. It's easy to plan for early retirement, if you know your savings will grow faster than your expenses.

Free up your time with Bitcoin investing

Stop spending hours of your valuable time analyzing stocks, indexes and trying to beat the S&P 500. Time is a zero-sum game, which means to have more time for one activity, you have less time for another. When you spend time doing things you could hire someone else to do, you’re using up time from more important matters. As you get older your time becomes more scarce and therefore becomes more valuable. No one knows how long they will live.

Follow my success and avoid costly mistakes by simply copying The Perfect Bitcoin Retirement Portfolio.

It only takes a few minutes to build a bulletproof early retirement plan.

Our clients will get everything needed to become a successful bitcoin investor.

Simple Step-By-Step Instructions

Supplement Social Security Income

Social security income will not be enough to live off during retirement. You will need more income. I will show you how to estimate your future monthly expenses. If you are planning to retire now, then you will need to start investing in Bitcoin. We take care of all the complicating stuff such as picking the right coins to invest in, choosing an exchange and selecting which wallets to use. All you need to get started is any crypto exchange account and The Perfect Bitcoin Retirement Plan.

Financial Freedom

With The Perfect Bitcoin Retirement Plan as your navigation, you can reach financial independence. We have done all the due diligence required and invest our own money in everything we recommend to our clients.

What happens after you reach financial independence?

We will show you how to automate many aspects of your personal finances such as automatically reinvesting and scheduling automated withdrawals. The final step is to reach financial freedom. This step will provide you with the ultimate currency in life, more free time. You will now have more free time to do all the things you enjoy spending time on.

If you want to retire early your portfolio needs to grow fast. This course will pay for itself as your portfolio grows in value. Financial education is the best investment you will ever make. You don't need to wait until your 65 to start enjoying life and you certainly don't need to be a millionaire to retire early.

In Bitcoin We Trust,

Avi Rosner

Our plan works using any crypto exchange

Learn how to

retire early from anywhere!

Copyright 2023 | All Rights Reserved

Past Results Is Not Indicative Of Future Results